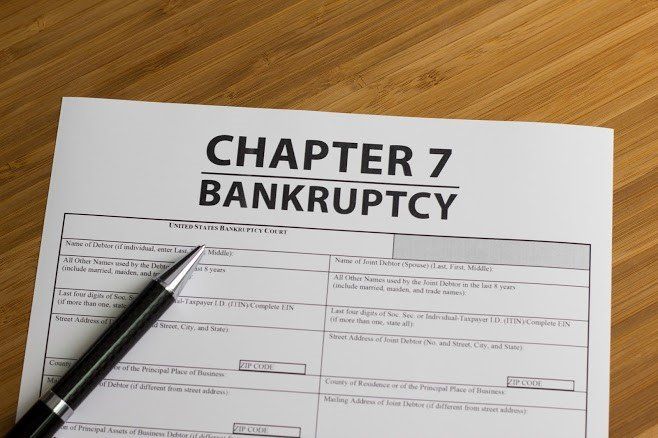

The Chapter 7 Bankruptcy Process in Appleton, WI: What to Expect for Homeowners in Bluffton, SC

What is Chapter 7 Bankruptcy?

Are you drowning in debt and struggling to make ends meet? If you're considering filing for Chapter 7 bankruptcy in Appleton, WI, you're not alone. Chapter 7 bankruptcy is a legal process that allows individuals to discharge most of their unsecured debts and start fresh. In this article, we'll provide a step-by-step guide on what to expect when filing for Chapter 7 bankruptcy, from the initial consultation to the debt discharge.

Initial Consultation

The first step in the Chapter 7 bankruptcy process is to schedule an initial consultation with a bankruptcy attorney in Appleton, WI. During this consultation, the attorney will review your financial situation and determine if Chapter 7 bankruptcy is the right choice for you. If you decide to move forward with the process, your attorney will help you prepare and file the necessary paperwork with the court.

Means Test

Before you can file for Chapter 7 bankruptcy, you'll need to pass a means test. This test is used to determine if your income is below the median income for your state, which would qualify you for Chapter 7 bankruptcy. If your income is above the median, you may still qualify for Chapter 7 bankruptcy depending on your expenses and other factors.

Automatic Stay

Once you've filed for Chapter 7 bankruptcy, an automatic stay goes into effect. This means that your creditors must immediately stop all collection efforts, including phone calls, letters, and legal action. The automatic stay will remain in effect until your debts are discharged or the bankruptcy case is dismissed.

Trustee Meeting

Approximately one month after you file for Chapter 7 bankruptcy, you'll be required to attend a trustee meeting. The trustee is a court-appointed official who will review your case and ask you questions about your finances and the bankruptcy petition. This meeting typically lasts only a few minutes and is relatively informal.

Debt Discharge

If everything goes smoothly, your debts will be discharged approximately three to four months after you file for Chapter 7 bankruptcy. This means that you'll no longer be responsible for paying most of your unsecured debts, such as credit card bills and medical expenses. However, some debts cannot be discharged in Chapter 7 bankruptcy, such as student loans and child support payments.

Regain Financial Stability with Chapter 7 Bankruptcy

Struggling with debt can be overwhelming and stressful. If you're considering filing for Chapter 7 bankruptcy in Appleton, WI, it's important to understand the process and what to expect. By working with an experienced bankruptcy attorney, you can navigate the process with confidence and start fresh. Struggling with debt? Contact us today to learn more about how Chapter 7 bankruptcy can help you regain financial stability.

Struggling with debt? Contact us today to learn more about how Chapter 7 bankruptcy can help you regain financial stability. Visit our website to schedule a consultation with our experienced bankruptcy attorney.