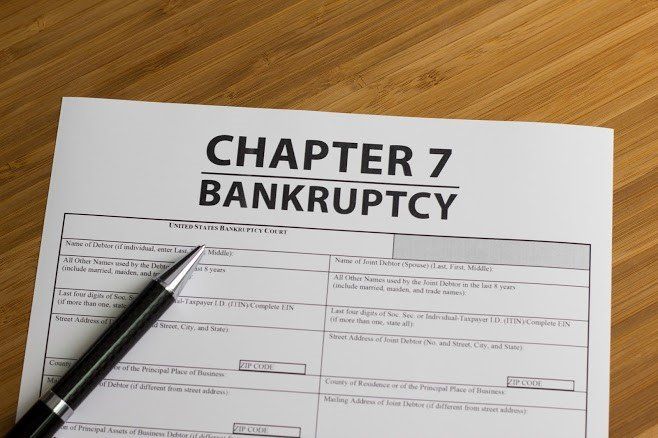

Bankruptcy Means Test

If you would like to file a Chapter 7 bankruptcy you must pass the means test.

Thetest only applies to higher income filers which means that if your income isbelow the Wisconsin median for your household size you are exempt from the testand may file a Chapter 7. If you areunsure where you fall from an income standpoint, please call our office at920-432-8801 and we will research it for you. If yourincome is higher than the Wisconsin median you will need to complete the meanstest calculation to determine if you can pay back a portion of your unsecureddebts through a Chapter 13 bankruptcy.

Means Test Exemptions

If yourdebts are not primarily consumer debts, then you are exempt from the means testin Ch. 7 Bankruptcy. You are also exempt from the means test if you are adisabled veteran and incurred your debt primarily during active duty orperforming a homeland defense activity.

Wisconsin Median Income

If yourcurrently monthly household income is less than the Wisconsin median income fora household of your size, there is a presumption that you pass the means testand are eligible to file a

Chapter 7 bankruptcy . Youraverage household income is determined by averaging your monthly income overthe last six calendar months. If you are over the median income limit and yourincome has declined over the last six months, then waiting one or more monthsmight bring your income under the median level for Wisconsin. Once youdetermine your average monthly income you multiply that by 12 to determine yourannual income for the purpose of Wisconsin median income test. 1Member Household - $43,958.00

2 Member Household - $57,903.00

3 Member Household - $67,808.00

4 Member Household - $80,198.00

5 Member Household - $88,298.00

6 Member Household - $96,398.00

7 Member Household - $104,498.00

8 Member Household - $112,598.00

9 Member Household - $120,698.00

10 Member Household - $128,798.00 If yourincome is over the Wisconsin median income for a household your size, then youmust complete the means test by calculating your income and expense information Youmust collection some of the information needed to complete the calculation,such as your current monthly income, from your own personal records Incomeincludes almost all of sources of income you may have including, but notlimited to, business income, rental income, interested and dividends, pensionsand retirements plans, amounts paid by others for your household expenses, andunemployment income. Much ofthe information related to your expenses are based on national, Wisconsin, andlocal averages and standards and comes from the Census Bureau and the InternalRevenue Service. There are some actual expenses you can include such asobligations you are legally required to pay and expenses necessary for healthand welfare. Afteryou have collected all the required information, you subtract all of yourallowed expenses for Wisconsin from your income to determine the amount ofincome under the bankruptcy law that you have available to pay your unsecuredcreditors in a Chapter 13 plan. If yourtotal monthly income over the course of the next 60 months is less than $7,475then you pass the means test and you may file a Chapter 7 bankruptcy. If it isover $12,475 then you fail the means test and don't have the option of filingChapter 7. If your disposable income under the means test is between $7,475 and$12,475 then you must do further calculations to determine if you have theoption of filing a Chapter 7 case. Meanstest calculations are complicated and there are other enhancements a goodlawyer can make to drive a better result. Attorney Foscato is equipped with the latest software and creativearguments to benefit his clients’ bottom lines. Keep inmind that just because you can file a Chapter 7 does not mean that should.Generally, a Chapter 7 bankruptcy is a better option if you are not attemptingto keep secured property like home with a mortgage but you should consult withan attorney to determine your options and the best course to take. If youhave questions or need help please call us, we will help. The LawOffices of John Foscato

920-432-8801 Oremail us at

attyjaf@new.rr.com